132 September – October – 2007

Our cooperatives aim to provide value on behalf of member owners and often take a wide-ranging approach on how to express and demonstrate that organizational accomplishment. When it comes to managing and reporting financial performance and condition, traditional financial statements do quite nicely. Financial statements are not good places in which to exercise “local control” in the form of creativity and uniqueness.

Our cooperatives aim to provide value on behalf of member owners and often take a wide-ranging approach on how to express and demonstrate that organizational accomplishment. When it comes to managing and reporting financial performance and condition, traditional financial statements do quite nicely. Financial statements are not good places in which to exercise “local control” in the form of creativity and uniqueness.

This article will focus on the Balance Sheet, one of the three reports that combine to make up what is commonly known as “financial statements.” To consider balance sheets within their proper context, it’s helpful to have a general sense of the different, yet related, roles of the three types of reports.

Income Statements (also referred to as Profit and Loss, or Operating Statements) are meant to capture all that is necessary to get to the bottom line—net profit or net income. This report shows sales, cost of sales, expenses and profit for a period of time (week, month, quarter, year, etc.) and then starts over for the next reporting period. A separate Cash Flow Statement is used for the management or reporting of cash flow, showing sources and uses of cash flowing through the organization. The “bottom line” of each of these statements is linked to and appears on the Balance Sheet (ending cash becomes cash on hand, and net income becomes or is added to current earnings). Hence, the balance sheet shows the co-op’s overall financial condition at a given point in time. The income statement and cash flow statements tell important parts of the story of how that condition came to be.

Income statements and cash flow statements are necessary tools if you are responsible for managing those systems. But, if you need to understand the co-op’s overall financial health, get a picture of its past success or failure, and or have an eye toward future financial condition, the balance sheet is your tool. For board members, then, understanding a balance sheet is a basic a need. This is why we focus on building an understanding of balance sheets in the Cooperative Board Leadership 101 and in this article. (See www.columinate.coop/cbld for more information.)

Stuff and where it comes from

To build an understanding of the usefulness of the balance sheet, start with this idea: The balance sheet shows what the co-op has and where it came from.

In the CBL101 sessions, we call what the co-op has, “stuff.” Can you picture all the stuff the co-op has? Everything is included, from cash to inventory to fixtures, maybe properties, trucks, supplies…everything. In balance sheet language, “Stuff” = “Assets.”

All stuff has to come from somewhere. In this case, it only comes from one of two places: inside the co-op, or outside.

- “Inside” is what the co-op owns. It is generated through earnings of the operation or is contributed by its members. On a balance sheet, the “inside” category is called “Equity.”

- “Outside” is money that the co-op owes and needs to pay back. On a balance sheet, this is called “Liabilities.”

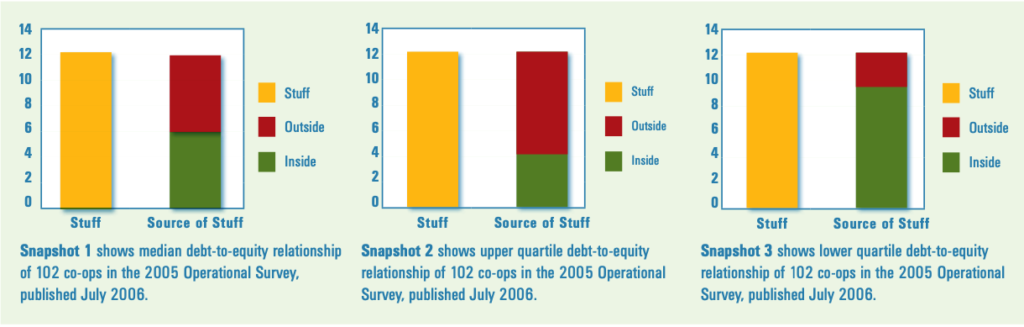

As you can see in Snapshot 1, all our stuff came from somewhere. In this example, it came from equal parts outside and inside.

You may have heard of this rule: Assets equal the sum of Liabilities plus Equity. Another way to say the same thing is that we have a bunch of stuff, we owe money for some of it (liabilities), and the rest came from money the members paid plus money the co-op earned (equity).

Balance sheet: a snapshot in time

The balance sheet is a snapshot taken at a moment in time. The information presented is cumulative, in that it summarizes all financial activity since the co-op began. Usually a balance sheet is produced at the end of a reporting period so that it corresponds to the other two types of reports produced at that time.

In the balance sheet you can easily see the relationship between debt (liabilities) and equity. In the sample above, these are equal—for every dollar of debt we have a dollar of equity. This would be a 1:1 debt to equity ratio. Where did all the stuff come from? Half from the outside and half from the inside. But we can say that only for the one moment when the balance sheet was produced, i.e., when the snapshot was taken. Look for the single date on a balance sheet to see when the snapshot was taken.

It’s handy to think of balance sheets as a sequence in a photo album that enables you to compare pictures over time. Think of a photo album of a child growing up with pictures taken once a year. If you compare the photos from year 1, 3, 5, 10, and 20, it’s easy to see that things have changed! It’s the same with a balance sheet: financial conditions changes over time, and you can see the change by comparing balance sheets.

Before we look at such comparisons, let’s look at just one snapshot. In Snapshot 2 we have “stuff” totaling 12. Where did the stuff come from? What is the debt-to-equity ratio (Expressed as ____ part debt to 1 part equity) in this example? (Quiz #1—see answer at end)

How about this example, in Snapshot 3? Again, how much stuff do we have? Where did it come from? What is the debt-to-equity ratio? (Quiz #2—see answer at end)

When we do this lesson using Legos in the CBL101 training, sometimes we hold up towers like the ones in the illustrations. Frequently someone will ask, “Is that okay?”—meaning is the relationship between debt and equity okay. The answer is, “It depends.” What’s the story, what’s the plan, the context?

Comparing balance sheets: a photo album

Both past history and plans for the future will help you understand and assess what you’re looking at in a single snapshot or balance sheet. To the right are three albums. Each one is a collection of snapshots and tells a different story. Take a look, asking these questions:

How much stuff do we have? What’s the trend?

Where did it come from? What are the trends?

What patterns did you see in each of these sequences? Take a look at Year 2 in each of the three comparisons. Each co-op has the same amount of stuff at that point. Then what happens? How would you describe the difference between Comparisons 1 and 2? How would you describe what you see in Comparison 3?

To do this exercise at home, look for total assets (stuff), total liabilities (out), and total equity (in) and see what patterns emerge. “Is it okay” is a good question, especially if you connect it to the larger patterns that emerge AND the overall aspirations of the co-op.

Adding detailThere is a bit more detail on a balance sheet. For example, in the comparisons above we can’t tell whether equity grew because we got a lot more members but made no profit, or because member paid-in equity stayed the same while earnings increased. Let’s break each of the three main categories—assets, liabilities and equity—into their next biggest pieces.

What is Current?

“Current” is generally defined as the next 12 months. “Current assets” would be cash, inventory and any other assets that would ordinarily be or become liquid, or cash-like, in the next 12 months. What we owe is not all due at the same time, or even in the current fiscal year. “Current liabilities” is typically defined as what’s due in the next 12 months. What’s not “current” is in the next account, long-term liabilities. (Note: adjustments between current and long-term liabilities might only be made at year-end.)

The Current Ratio

This compares current stuff/assets to current debt/liabilities. The current ratio is handy because you can easily see the relationship between stuff you have that will be used to pay the bills in the next year, and how much is owed in the next year. The current ratio as shown in the graph above would be a 2:1 current ratio: for every dollar of current liabilities, there are two dollars of current assets. The higher the ratio, the stronger the relationship between current assets and current debts.

Where did our Equity come from? Equity for our food co-ops comes primarily from earnings and member paid-in equity. On the balance sheet, both numbers track the cumulative totals since the beginning of the co-op. “Earnings” may be broken into two categories: All earnings from the beginning of the co-op (retained earnings) and profits during the present reporting period (earnings). With the album of snapshots you can see how all types of equity have varied from snapshot to snapshot.

Getting the picture, seeing relationships

With a balance sheet you can ask good questions about key relationships that make up the co-op’s financial position and trends: What’s happening with our assets—going up, down, or staying the same? Why? Are we profitable? Why or why not? Can we meet our obligations? How much capital have members invested? How do we think about our level of indebtedness?

Coupling the balance sheet with plans for organizational accomplishment can bring in another level of questions: Are we on track? Is there a match between the co-op’s aspirations for the future and its financial readiness? What do the key balance sheet trend lines look like when extended into the future?

These questions ought not be just the territory of the “numbers people” or accounting types. Anyone should be able to see how much stuff the co-op has and where it came from. Once you get that picture you are ready to engage in meaningful conversation about the co-op’s past, present and future. Give it a try!

(Quiz Answers 1: 2:1, Quiz 2: .33:1)

Have more questions?

Get in touch with one of our consultants.