Bruce Mayer’s “Patronage Dividend Primer” article in the toolbox outlines the three key decisions:

- How much of the eligible profits should be allocated?

- What percentage of the allocated profits will be distributed?

- What is the method of distribution, and what minimum amount will the co-op be distributing?

The sample report on the following pages shows a straightforward way of presenting key information to help the board make the decisions they need to make.

Notes to this sample report

- The range of scenarios the GM presents should make sense for you and your co-op. This range is presented for illustration purposes only.

- The Cash Needs Analysis should relate to the multi-year plan and next year’s budget. Again, the items in this analysis are presented just as examples.

- The distribution methods presented in this report are also presented as examples. The Primer recommends using store credits (that can be redeemed for cash) if allowed by your state law. This sample report includes an option for donating uncashed checks; this option is dependent on a corresponding bylaw. If your co-op does not have such a bylaw, IRS rules must be carefully followed for uncashed checks; taxes will be owed on the entire amount of patronage allocation for people who don’t cash their checks.

- As with all templates, use this one as a guide for how to present an analysis and recommendations; the actual information the GM presents should make sense for your co-op.

SAMPLE PRESENTATION

Patronage Dividend Analysis

To: Board of Directors

From: General Manager

Date: October 1, 2019

Introduction

This report outlines different scenarios for giving a Patronage Dividend to the owners of the XXX Food Co-op. The format is based on a decision tree from the article “Patronage Dividends: A Primer,” from Patronage Dividends for Food Co-ops, available at https://columinate.coop/patronage-dividend-primer/. I will use the same layout with figures in the appropriate areas as scenarios followed by a cash needs analysis, my recommendation for cash disbursement, an analysis of executive limitations ramifications, and historical information.

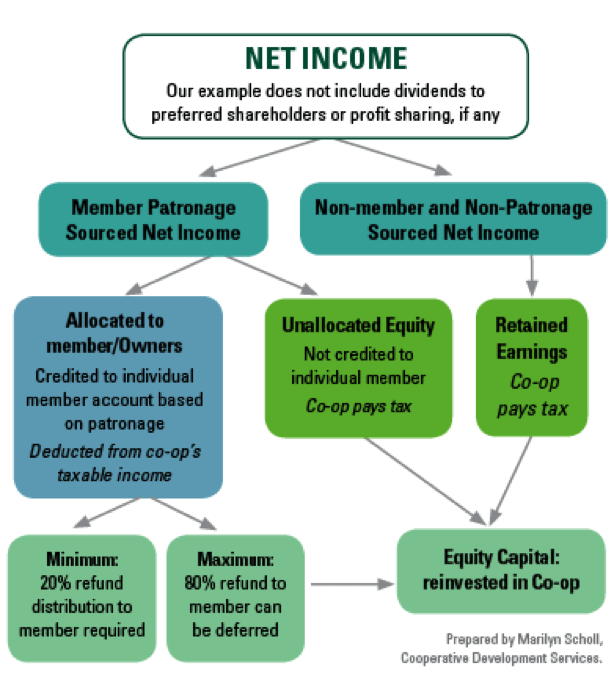

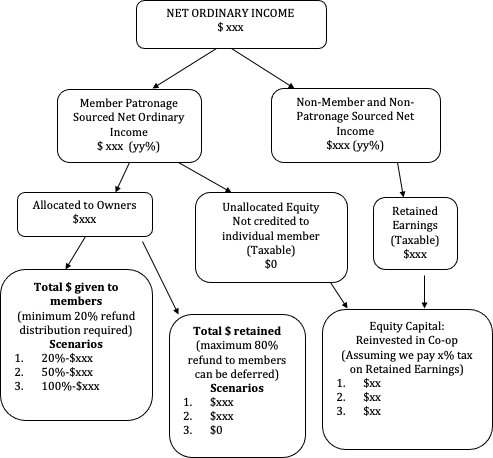

Below is the model used in determining the patronage dividend. Our “Net Income” (the top box) for FY2019 is noted on our income/expense statement as net ordinary income: $xxx. Our “Member Patronage Sourced Net Income” (MPSNI ) for FY2019 is determined by the following formula: MPSNI = (sales to members / total sales) x net income.

In FY2019, sales to members were $xxx; total sales were $xxx; and net income was $xxx. Plugging all the numbers into the formula, we see that our MPSNI for FY2019 was $xxx, or yy% of our total income.

Decision Points and Recommendations

Decision #1: How much of the eligible profits should be allocated?

Since the owner sourced profits are only tax-exempt if allocated to members, I recommend we allocate 100% as we have in previous years.

Decision #2: What percentage of the allocated profits should be distributed?

I have prepared 3 scenarios for your information. I recommend scenario #1; in this scenario, the Board would distribute 20% to owners and retain 80% of the allocated patronage.

In my FY 2019-2022 Business Plan (provided to the Board along with my recent L6—Planning and Budgeting report, and accepted at the June meeting), I included a description of how we were planning and budgeting for this year’s patronage dividend allocation decision. This recommendation is consistent with the plan I presented. The projections in the FY 19-22 Business Plan rely on full utilization of the patronage dividend system (allocating 100%, distributing 20%) to retain the capital needed for our development plan. In particular, the retained patronage helps contribute toward capital improvements, purchasing property, and saving for our next expansion opportunity.

Decision #3: What is the method of distribution, and what minimum amount will the co-op be distributing?

I recommend we use the same method of distribution we used last year: mailed checks to members, with instructions that they can

- cash the check, or

- endorse the check to the co-op for donations to Hunger Free, or

- do nothing (leave the check uncashed), in which case we will follow our bylaws and donate all uncashed patronage checks to the Local Farm Foundation. (Important: see Note #3 in the Field Guide introduction.)

Further I recommend that the minimum amount for distribution is $xx. Once we account for the administrative, processing and postage costs, it would cost us more than the value of the check to sending out checks for less than this amount.

Executive limitations ramifications

In my most recent L5 – Financial Conditions report, I wrote:

(This is just an example of what this imaginary GM might have written in her/his Financial Conditions report.)

“In our cooperatively owned business, member equity provides the capital we need to support our business. A sufficient amount of this equity would allow us to leverage (borrow) more funds if we need to expand or grow our business. Member equity comes primarily from four places: our equity shares, retained earnings, retained patronage dividends, and net income. In terms of current operations, a sufficient amount would be one that leads to a healthy debt-to-equity ratio. Managers of NCG co-ops have set a benchmark for debt-to-equity of no higher than 3:1. Based on my more conservative approach to debt, I have set a target for our debt/equity ratio no higher than 2:1. As long as our actual ratio is lower than this goal, I indicate compliance with the board’s policy.”

Below is a chart showing the Debt to Equity ratio in all three scenarios and the current debt to equity as of September 30, 2019. All three scenarios keep us out of danger and are well below the target and accepted guidelines.

| Scenario and Amount | Debt to Equity |

| 1 – $xx | xx:1 |

| 2 – $xx | xx:1 |

| 3 – $xx | xx:1 |

| Actual 9/30/19 | xx:1 |

Also in my last L5 report, I wrote:

“Cash needs are vital to our success. In order to ensure that our business can meet these needs into the future, I must maintain a current ratio (current assets/current liabilities: the relationship between the bills we will soon owe, to the assets we have with which to pay those bills) at a high enough level. In following the NCG benchmark guidelines, I have set a current ratio goal of greater than 1.25:1.”

Below is a chart showing the current ratio in all three scenarios and the current ratio as of September 30, 2019. The three scenarios are well above the target and accepted guidelines.

| Scenario and Amount | Current Ratio |

| 1 – $xx | xx:1 |

| 2 – $xx | xx:1 |

| 3 – $xx | xx:1 |

| Actual 9/30/19 | xx:1 |

Based on the analysis in the two tables, the board will not adversely affect the current financial condition of the business no matter how much patronage rebate you give back to our owners. So the only limits may be how the patronage rebate would affect the future needs of the co-op.

FYI: Patronage Dividend history

The following table shows how a 20% distribution compares to what we did the past several years.

| Patronage Refund % | Average refund/member | Avg. Retained Dividend/member |

| Suggested 2019 – 20% | $xx | $yy |

| Actual 2018: y% | $xx | $yy |

| Actual 2017: y% | $xx | $yy |

| Actual 2016: y% | $xx | $yy |

Have more questions?

Get in touch with one of our consultants.