You can compare your co-op’s general manager (GM) compensation with over 100 others in the Columinate Compensation Database. And the more co-ops that use the database, the more useful this tool will be for all co-ops. If a co-op GM has not already registered for the database, they can do so by going to compensation.columinate.coop and following the prompts. If the co-op is a member of NCG, database registration is free.

Note that the Compensation Database has expanded its scope to include all other management positions—and here, again, your participation in the database is strongly encouraged.

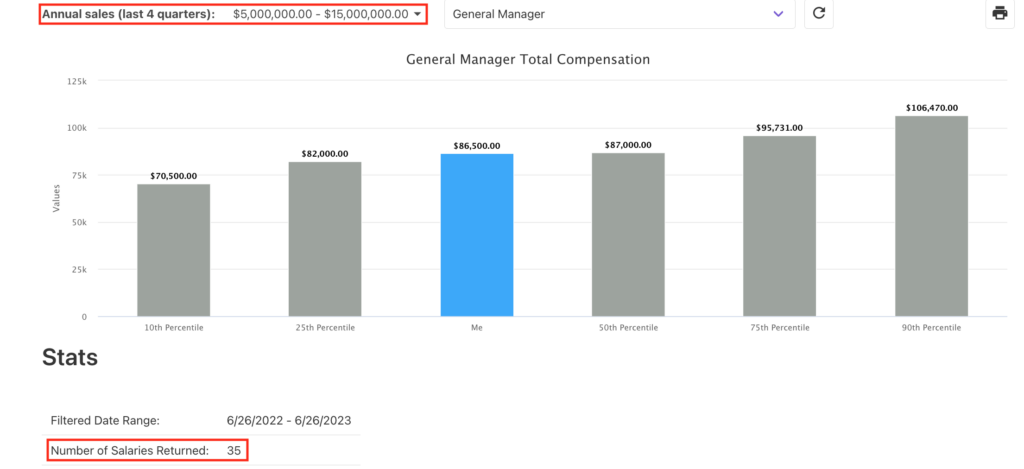

When a co-op GM registers for the Columinate Compensation Database and enters their data, they see a dashboard, such as the one shown here, that compares their own compensation to those of other GMs.

What the dashboard shows is total compensation: base salary plus any contingent pay plus any deferred compensation expected this year. Here, I’ll unpack total compensation.

Note: Database users only see the entries from the previous 12 months. At the time of writing, there are 94 GMs in that dataset. However, for the purposes of this article, I’m going back to January 1, 2022 for a larger sample of 119 GMs.

Contingent pay

The practice of contingent pay for co-op general managers is declining. Contingent pay, sometimes called variable pay, is remuneration paid out upon achievement of specific, agreed-upon goals or conditions, usually in the form of an annual or quarterly bonus. Of the 119 GMs in my sample, 40 (33 percent) have some form of contingent pay. This represents a continuing decline in contingent pay practice, down from 50 percent in 2020. Since the database started tracking GM compensation in 2010, 21 managers who once included contingent pay in their total compensation no longer do so, while only three who started out without contingent pay have added it.

Interestingly, there is no pattern connecting a co-op’s sales volume to whether a GM has contingent pay as part of their total compensation. This, too, is a departure from the past, when GMs of larger co-ops were more likely to include it in their total compensation.

When asked for the goals or conditions on which their contingent pay is based, the 40 GMs listed multiple criteria, most commonly financial, such as net income or EDITDAP and sales growth. Ten of the 40 had non-financial criteria including achieving ends policies, complying with executive limitation policies, or board discretion.

Database participants are asked for both the amount of contingent pay they expect to receive in the coming year and the maximum potential amount they could earn. Of the 40 with contingent pay plans, 25 (63 percent) have a maximum potential bonus of 10 percent or less of their base salary. Only six out of 40 have the potential to earn more than 20 percent of their base salary.

It appears that most co-op GMs do not view contingent pay as a significant part of their total compensation. While boards of directors have the final say on their GM’s pay package, in many co-ops it is the GM who proposes their own compensation for board approval. Presumably, if a GM does not have contingent pay (or no longer does), this situation was not imposed upon them by their board.

If so, why are GMs proposing low amounts of contingent pay or abandoning contingent pay all together? I have some thoughts, based on anecdotal evidence:

- Contingent pay does not act as a performance incentive for some people. As one co-op GM said to me, “I love the co-op. I’m already giving 110%. It’s not like I’m going to put out a higher effort for more money.”

- The pandemic introduced massive uncertainty into the retail environment, with continuing aftershocks. Having a significant amount of compensation riding on factors outside one’s own control may lack appeal.

- Inflation impacts earning power. GMs may be seeking more certainty (“a bird in hand is worth two in the bush”).

In deciding whether to include contingent pay in total compensation, boards and managers should think about its purpose. Rather than seeing it as an incentive, it could be viewed as a hedge. If a board is uncertain about whether a big raise will be affordable to the co-op, making some of that raise contingent on quarterly financial results could assure the board that the money will be earned to pay the bonus.

Deferred compensation

With deferred compensation, a certain sum is set aside, invested and paid out later—typically but not necessarily upon retirement. Examples include Supplemental Executive Retirement Plans (SERPs), qualified and non-qualified retirement plans, and interest-bearing life insurance plans. Only in the last two years have we started collecting data on deferred compensation, so it’s not possible to speak of a trend. At this point, 10 percent of GMs list deferred compensation as part of their total package.

Special benefits

The database asks GMs if they receive any benefits not available to other staff. A little over half (52 percent) have at least one such benefit. Additional paid time off is by far the most popular special benefit. Anecdotally, when I’ve supported boards in a GM hiring process, the GM candidates always negotiate for more vacation than they would get with the standard staff benefit package.

Reported GM special benefits

|

Additional Paid Time Off |

37 |

|

Cell phone plan |

12 |

|

Life, short-term, and/or long-term disability insurance |

10 |

|

Professional development |

8 |

|

Health insurance benefits |

6 |

|

Other |

11 |

I’ll end with a plea to all co-op general managers: Please update your entries, especially for the other management positions at your co-op. If you haven’t already registered, it’s easy. Just go to compensation.columinate.coop and follow the prompts. And to boards: ask your GM to register. Again, the more co-ops that use the database, the more useful this tool will be for all co-ops.

Frequently Asked Questions

How current is the Columinate Compensation Database?

Your dashboard will show you only the data entered within the past year. If you visit the database on July 1, 2023, you will see only the entries made since July 1, 2022. This ensures that the data is always current. However, it means that GMs need to be vigilant about updating not only their own compensation but that of the other management positions at their co-op.

Why am I getting the message, “Not enough salaries returned,” when I look up Category Manager?

The database sets a minimum of five data points before it will show you results. You’ll get that message when there are not as many as five individuals with salaries entered for that position within the sales volume parameters you set. Trying widening your database parameters.

Can I give my HR manager authorization to access the database?

Yes. As GM you are the “primary user.” You can designate HR or another manager to be a “secondary user.” Secondary users can maintain the salary information for other management positions at the co-op, but they will not have access to the GM’s salary data. Only GMs can see GM compensation numbers.

I’m on the board of directors. I would like access to the database.

If you have a GM in place, ask your GM to register and share the data with you. If you are currently without a GM and are looking for what similarly sized co-ops are paying their GMs, please contact the database administrator at compensation@columinate.coop.

Will there be surveys like the ones that Cooperative Grocer magazine used to publish?

Not in that form. GM compensation information is dynamic. Published surveys quickly fall out of date. Individual database users can create their own datasets within the sales parameters that are most useful to them. Rather than a survey, we will publish a quarterly series of articles that analyze the data collected. For my third quarter article, I will address location and cost of living variables.

Thanks to National Co+op Grocers for supporting the database for NCG members!

Have more questions?

Get in touch with one of our consultants.